This year is certainly thus far proving to be a tough year for BTC bulls. With the first half of 2018 behind us, the second half begins with BTC trading at the lower end of 6000.

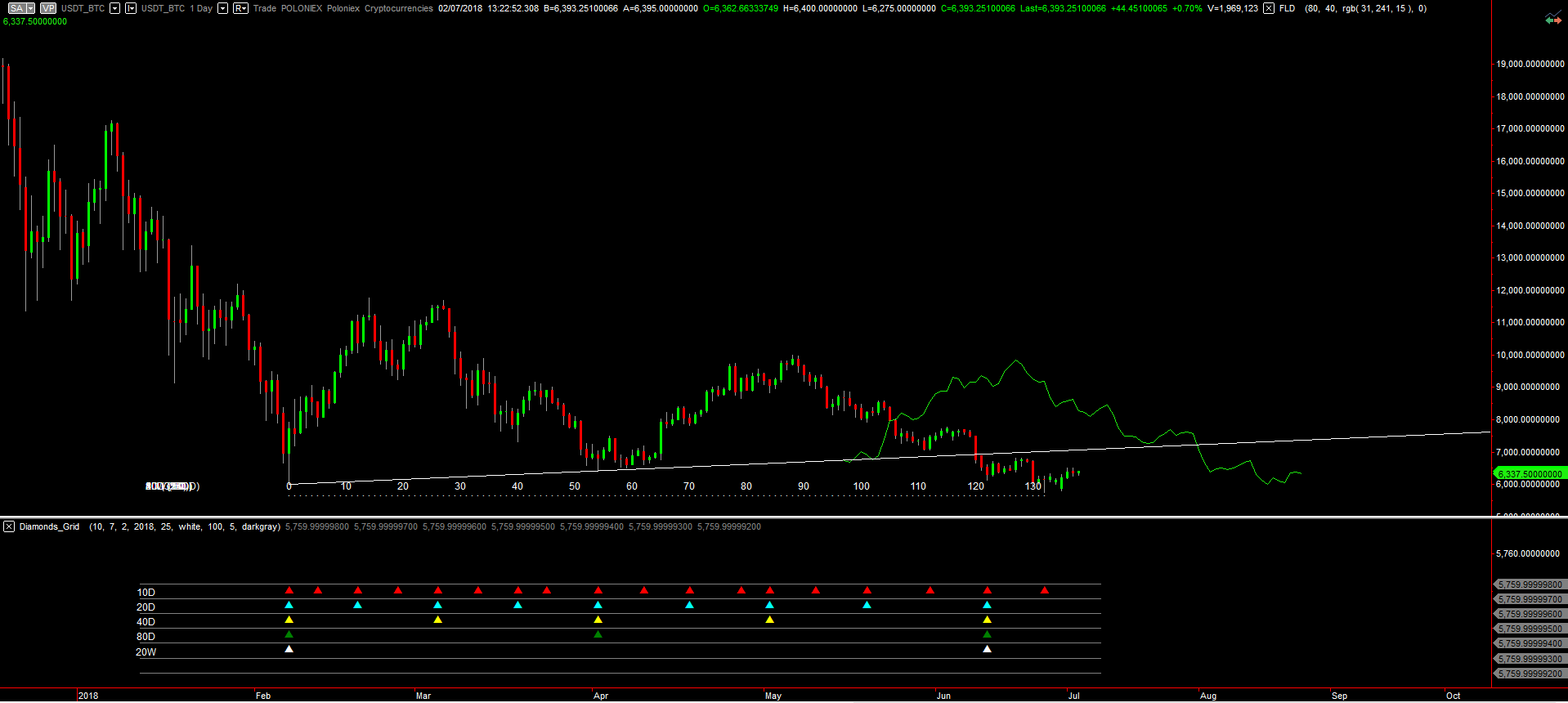

Applying the Hurst cycle approach, the focus is on a potential end to the 20W cycle that began on 7-Feb. The reference date for the end of this cycle is 14-Jun. This suggests price action since 14-Jun marks the early stages of the next medium-term 20W cycle. What appears to be clear, is that the cycle has started on a neutral to bearish note and unfortunately for bulls, the risk appears to be growing that we are likely to see continued selling pressure over the near-term and most likely over the next few weeks too.

The key observations are:

1. As the 20W cycle approached its trough, an important trendline that referenced this cycle was breached. Typically such a development is used to confirm the peak of a cycle. The impact of the trendline break however has been a breach recently of the 7-Feb low which had until recently marked the low thus far for 2018.

2. BTC is also failing to display any potential to rally. Furthermore, the first 10D cycle of the new 20W phase is complete and in turn generated the recent fresh low for 2018.

3. A clear break below the 7-Feb low of 6012.62 and the most recent lows just below 6000, would essentially confirm a resumption of the bearish tone.

To summarise, BTC looks as if it has started the second half of the year on a softer note once again. The cycle structure, recent price activity and a breach of an important cycle related trendline together deliver a bearish verdict on BTC.

Good luck!

About the author: Taso Anastasiou is an experienced technical analyst who after all these years still finds the challenges of predicting market movements stimulating. Taso has been involved in the field of communicating financial market ideas for over 20 years having done this through a dedicated research house and the investment banking sector.